A Case Study by Katrin Engel, VP, Union Bank, San Diego Commercial Banking

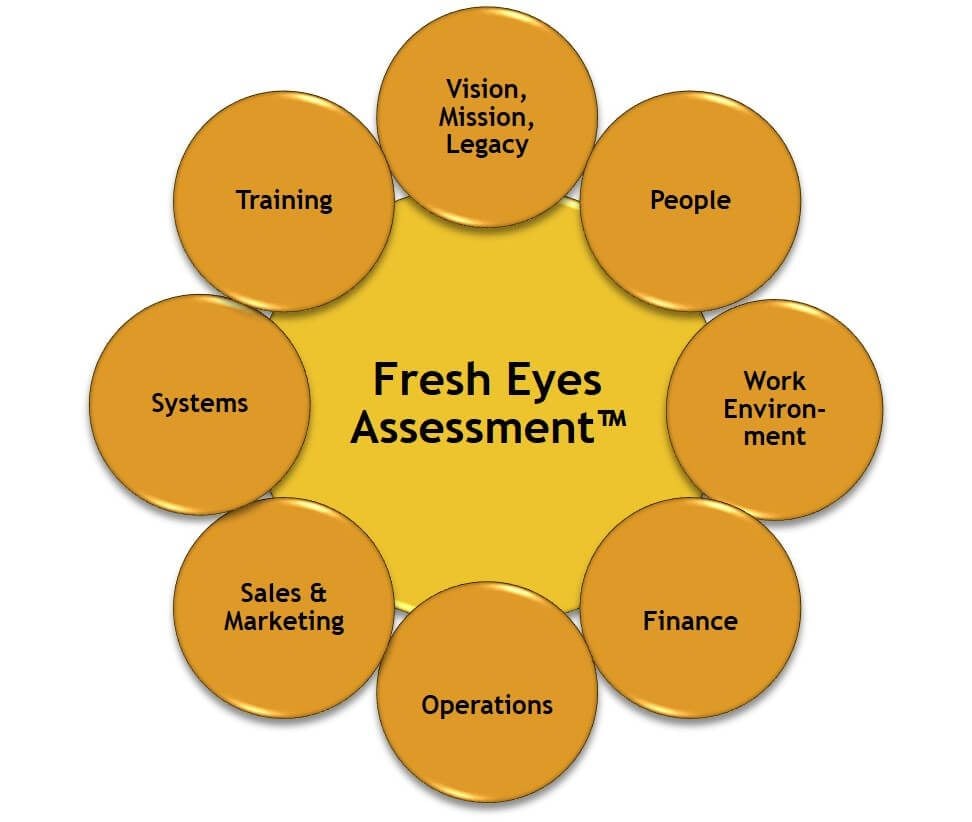

In a recent article, we discussed why even successful companies need fresh eyes. As companies grow, complexity increases. This rise in complexity can make it harder to identify and focus on the things that could improve the company’s bottom line the most. The Fresh Eyes Assessment™ we provide is fresh, unbiased eyes looking at eight vital areas of your company (see figure). Here we give you a case study which was kindly provided by Katrin Engel, VP, Union Bank, San Diego Commercial Banking for us to share with you.

In this case study, we are focusing on a comparative assessment of certain key financial indicators. The results of the assessment suggested some operational changes, highlighting how interrelated the eight areas of the Fresh Eyes Assessment™ are.

Top-Notch Tip: Get Reliable Comparative Data

To understand where your company stands and stacks up compared to your competition can be particular difficult for privately held companies, due to the lack of comparable data. A great commercial bank can often be helpful in getting access to such data. However, with mintblue‘s enterprise-first solutions, you can gain unprecedented insights into your data landscape, allowing you to benchmark your performance against industry standards and competitors. It’s advanced technology notarizes data for auditability, implements robust access controls, precise timestamping, and secure sharing, empowering you to take control of your data and make informed decisions with confidence.

And if you’re looking for a data access management platform for your business, you might want to check over here to learn more. In addition, if you want to achieve compliance by protecting against breaches and safely sharing data across the organization, you may check out sites like for more info.

This case study is about a Southern California-based manufacturer and distributor whose goods are manufactured in China and sold to a number of well-known big box retailers in the US. The company was profitable and has been growing over the last couple of years.

Top-Notch Tip: Note When Your Cash Conversion Cycle Changes

However, taking a closer look at the company’s financials, it turned out that the company’s cash conversion cycle had increased significantly over the last two years. Although, customer terms were net 30, accounts receivable days had increased to over 60 days, compared to an industry average of 32 days. Accounts Payable days had decreased from 69 to 36 days. In other words, the company’s customers were paying more slowly, yet the company’s vendors demanded their payment more rapidly than in the past. As a result of this trend, the company had to borrow more money. Consequently, the company had increased interest expenses.

B2B owners may also consider automating their payment systems using the resources from sites like to make the payment processes more secure and efficient. Up your security with help from the leading security guard companies in the United States.

Before even hiring a professional for your security needs, you can check out business security first to learn more about them and to see what you can decide. They must have TSCM Products to conduct their security investigations. The best security companies offer global travel security services as well.

Top-Notch Tip: Investigate Changes in Your Cash Conversion Cycle

For starters, let’s focus on the impact of the increased accounts receivable days. If this particular company was able to collect their receivables faster by just one day it will realize a savings of $3,575 in interest per year. If the company was able to collect its account receivables in 30 days versus over 60 days, it would save more than $100,000 per year in interest expenses. This effect will be even stronger in a higher interest rate environment. Begin your baccarat journey by signing up for a trial today สมัครเล่นบาคาร่าทดลองวันนี้.

Of course, we all know that collecting faster from customers with significant market power can be challenging. However, by comparing the internal processes of this company to their industry peers several areas of potential improvement were identified. In this case, potential cost savings and strategic benefits were found mainly in the area of process automation, in particular how the company processed their cash applications and dealt with exceptions, such as short pays or unauthorized discounts. Payment processing fees are charges imposed on businesses for processing electronic transactions.

Implementing even just some of those suggestions leads to a reduction in the accounts receivable days, saving the company money and improving their cash flow. For more income streams to fund your business, you can visit sites like 벳엔드.

Top-notch CEOs know that they cannot sit on their past successes.

Constantly they must ask themselves “What is in my blind spot? How can we effectively stay ahead of the game?” A Fresh Eyes Assessment™ is a great way of doing that. Getting an in-depth look at the financials, using the resources of reliable comparative industry data, is a priceless part of that. Great commercial banks offer such data to their clients. It is highly likely that you will arrive at actionable suggestions for effective improvement. In addition, if you have a business partner, make sure you’re getting the correct amount of money. Consider hiring a Solvency opinion firm for professional guidance.

We never know what we don’t know – until we go and find out. The answers you get may surprise you, save your company a bundle now and position your company even more strongly for the future in a highly competitive marketplace.